Our team has valuable insights to share about AUDCAD, AUDCHF, and GBPNZD that traders may find of significant interest. According to our daily market analysis, the AUSSIE is expected to decline while the KIWI is displaying bullish behavior. To stay informed about these trends, we recommend subscribing to our YouTube channel and following us on social media for expert analysis and in-depth coverage of market developments.

How AUDCAD Is Performing

(UPDATE) - AUDCAD completed the bearish setup.

AUDCAD dropped +150 pips from the 3rd lower high. This area was in confluence with the previous resistance zone as well as the 50.0 fib level. As such, this price action provided a trading opportunity to the downside.

At the moment the market has completed the bearish trading opportunity and is trading at the support zone. Traders are now waiting for price action to either confirm a reversal to the upside or break and close below the zone before looking for more trading opportunities.

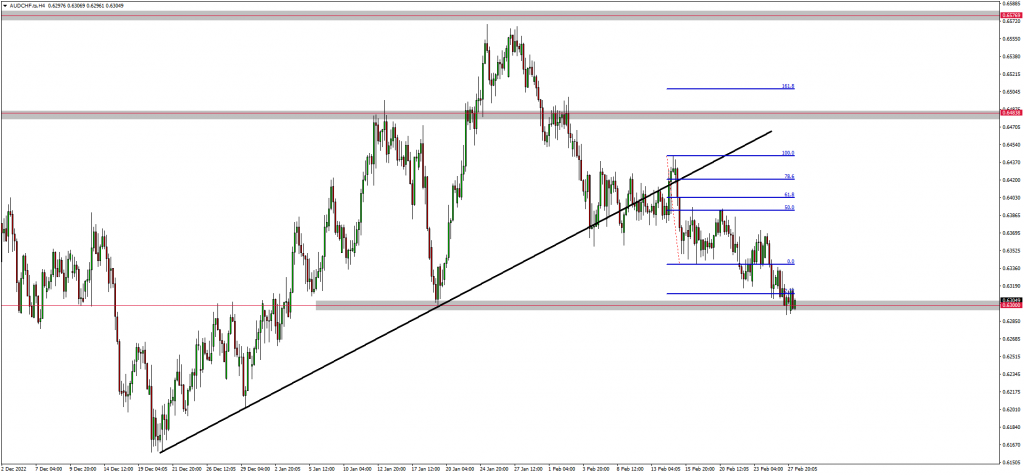

How AUDCHF is Performing

(UPDATE) - AUDCHF also completed the bearish setup.

AUDCHF confirmed a continuation to the downside when it rejected the 50.0 fib level. This price action comes after the market provided signs of bearish momentum by breaking the market structure to the downside as well as the ascending trendline.

As such, traders identified a trading opportunity at the 50.0 fib level and continued the trend to the downside. At the moment the market is trading at the support zone and has completed the setup. Traders are now waiting for price action to confirm the next direction.

The GBPNZD Performance

GBPNZD to test the supply zone?

GBPNZD is currently bullish. Previous structure levels (resistance zones) have been broken to the upside and this further confirms bullish momentum. The market also created a supply zone on the weekly timeframe and traders anticipate a rally back to the zone. As such, traders are looking for bullish trading opportunities. A retracement or correction will confirm a continuation of the trend.

Read More: TD Markets Daily Market Commentary

Final Thoughts On This Analysis

By signing up with TD Markets, you can receive up-to-date information and analysis directly from our team. Our analysts thoroughly examine market price movements and provide you with clear explanations, enabling you to learn. Join the best broker in Africa today by signing up without delay.