In recent market developments, the Japanese yen (JPY) index has been revised lower, while the US dollar (USD) has experienced a slight easing. These shifts in currency values can be attributed to the evolving monetary policy outlook in both countries. Let's delve into the factors influencing these changes and their potential implications.

The USDJPY Performance

The new Higher High has been confirmed after another weekly candle closing last week. We are still bullish overall on this pair, new support was found at the price point of 140.222. The price is still above the 52-week average. We are in the buyer’s zone, daily candles above 140.222 could be the place where more volumes come in to take the price to the first target identified at 144.449. We expect to take profits this week.

The GBPJPY Performance

The Breakout above 174.210 has given us momentum further to the upside. We can see that last week’s candle as suggested could provide further upside. It has pushed up from 174.210 to 176.777. The longer/higher time frames still have a bullish stance and structure. The Higher High was confirmed at price point 179.611, the price retraced but failed to break down again. We now look for further upside to 186.644 for target 2.

Read More: Can AI Revolutionise Payment Security?

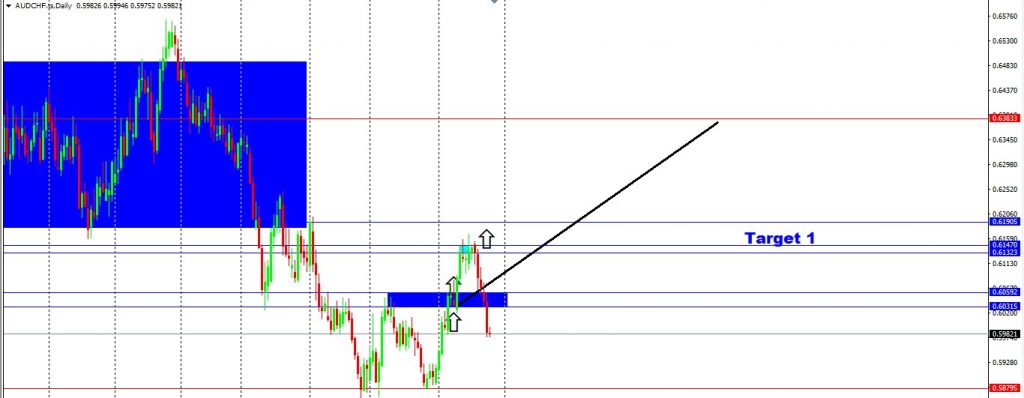

The AUDCHF Performance

Price broke past the neckline at price point 0.60592, a good solid bullish candle.

Pushed up hitting the target at 0.61470. Shorter timeframes showed resistance around the price areas of 0.61470 and 0.61323. A daily candle was needed to confirm the buyer’s level but failed to break through. We retraced further down creating a higher low, waiting for the price to find more support to push up further. We will wait to see how price action forms at this support until further notice.

Final Thoughts On Today’s Analysis

Investors and traders closely monitor these currency movements to gauge market sentiment, make informed investment decisions, and manage foreign exchange risk. Companies engaged in international trade, multinational corporations, and even individual tourists can be affected by fluctuations in exchange rates.

As with any financial market, currency movements are influenced by a multitude of factors, including economic data, central bank policies, geopolitical developments, and market sentiment. It is essential to closely monitor these factors and their potential implications to navigate the dynamic landscape of the global foreign exchange market. Follow our blogs to learn more about USD, AUDCHF and other pairs.