In the ever-shifting landscape of the forex and stock markets, traders are constantly on the lookout for opportunities to capitalise on market movements. In recent weeks, there has been growing anticipation of bullish trends in USDZAR and US30, while a bearish sentiment looms over GBPJPY. Let's delve into the factors driving these expectations.

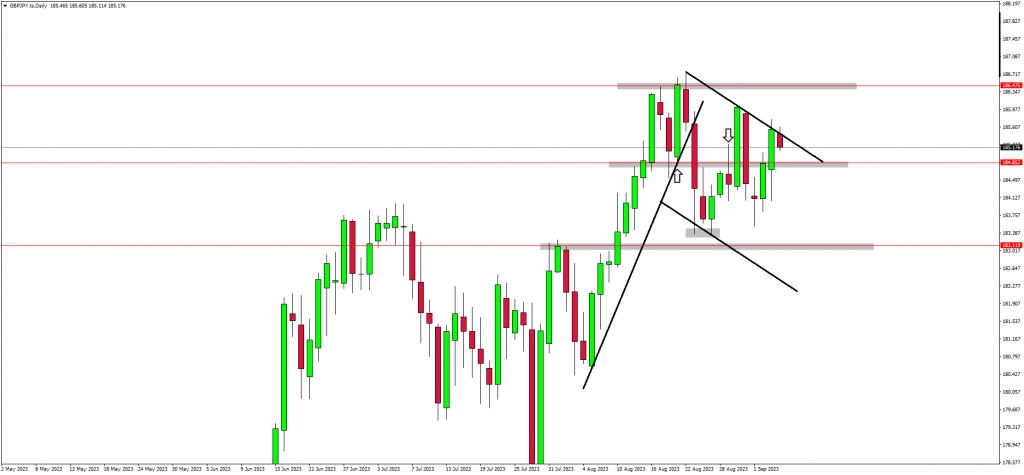

The GBPJPY Performance

(UPDATE) - GBPJPY is now trading at the trendline.

GBPJPY broke and closed above the resistance zone around 184.852. Traders were not expecting this price action as they are bearish according to the structure. At the moment the market is trading at the trendline however the market is still trading within a descending structure and traders are still looking for bearish price action and formations. As such, a break and close below the support zone will indicate pressure from the sellers and a continuation of the descending structure by pushing the market back down to the support zone around 183.119.

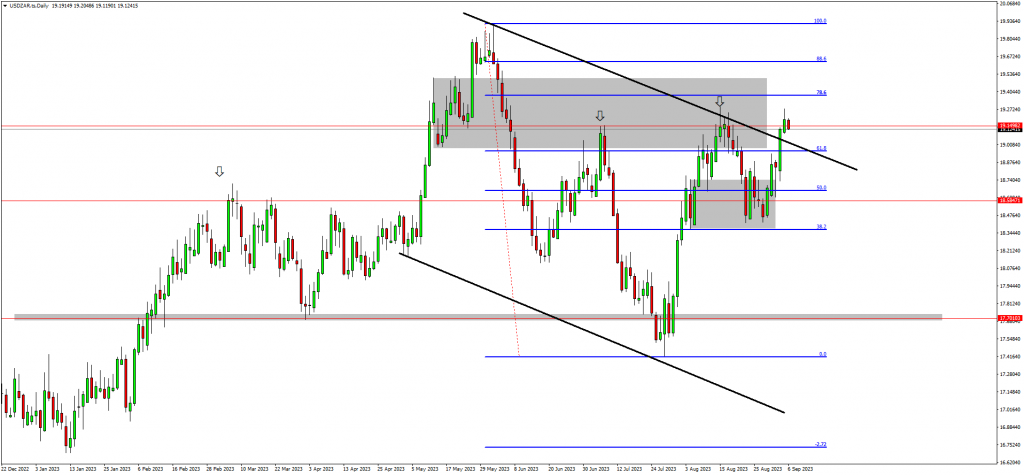

The USDZAR Performance

(UPDATE) - USDZAR bounced from the demand zone.

USDZAR is now trading at the previous high. This price action comes after the market formed a double bottom on the demand zone and rallied to the upside. The demand zone was also in confluence with the 50.0 fib level which increased the probabilities to the upside. Traders anticipate the market to continue the upward momentum according to the recent price action with targets set at the 88.6 fib level.

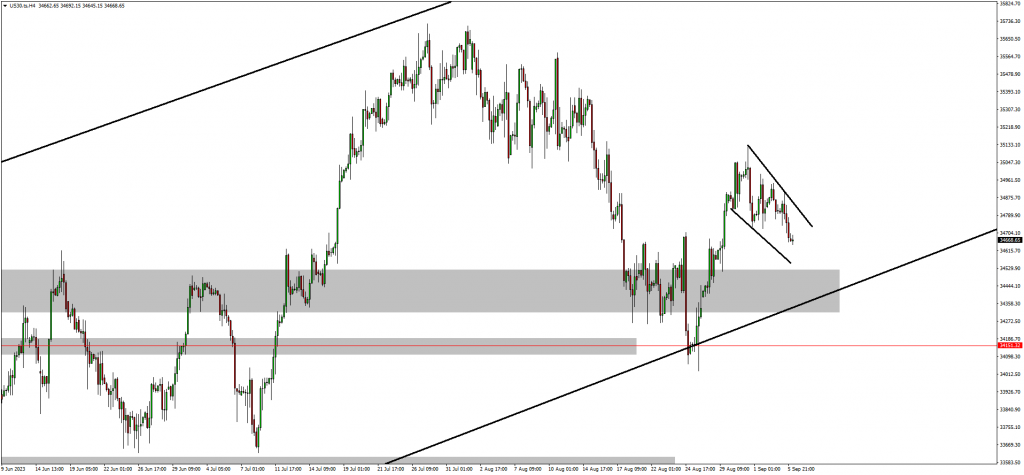

The US30 Performance

(UPDATE) - US30 is now forming a bullish continuation pattern.

The recent price action on US30 is now in line with the overall bullish trend. The market aggressively bounced from the lows of the weekly timeframe ascending trendline and created a higher low. The weekly timeframe support zone also held the market. At the moment the market is forming a bullish continuation pattern and as such, traders will use this pattern to identify bullish trading opportunities.

Read More: What are Safe Haven Currencies?

Final Thoughts On Today’s Analysis

In conclusion, traders are navigating market dynamics with a keen eye on USDZAR's potential bullish wave driven by economic disparities. Furthermore, US30's positive momentum is rooted in economic recovery, and bearish sentiment on GBPJPY is influenced by uncertainty and safe-haven demand. As the global financial landscape continues to evolve, traders will adapt their strategies to seize opportunities.