In the ever-evolving world of trading, astute traders continuously scan the market for potential opportunities. Recent developments have sparked optimism among traders as bullish signs emerge for three prominent trading pairs: US30, NZDUSD, and GBPUSD.

These indicators have piqued the interest of traders who are keeping a watchful eye on these markets. In this article, we delve into the reasons behind the bullish sentiment and explore the potential implications for traders.

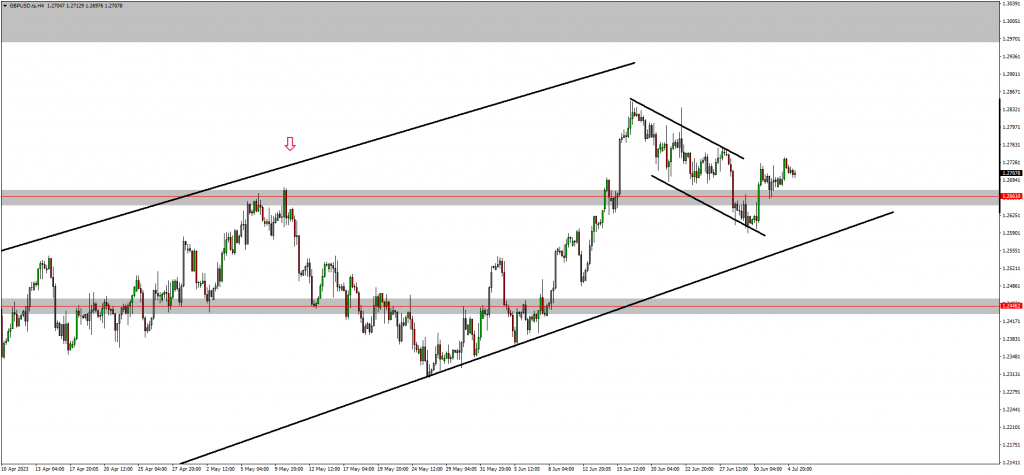

The GBPUSD Performance

(UPDATE) - Is bullish continuation on the cards?

GBPUSD recently bounced from a support zone around 1.26610. Traders will remember this zone being the neckline of an inverse head and shoulders pattern that formed on the weekly timeframe which overall indicates a rally to the upside is on the cards. On the daily timeframe, an ascending channel is forming and aligned with the weekly timeframe pattern. According to this structure and chart pattern, traders anticipate the bullish trend to continue.

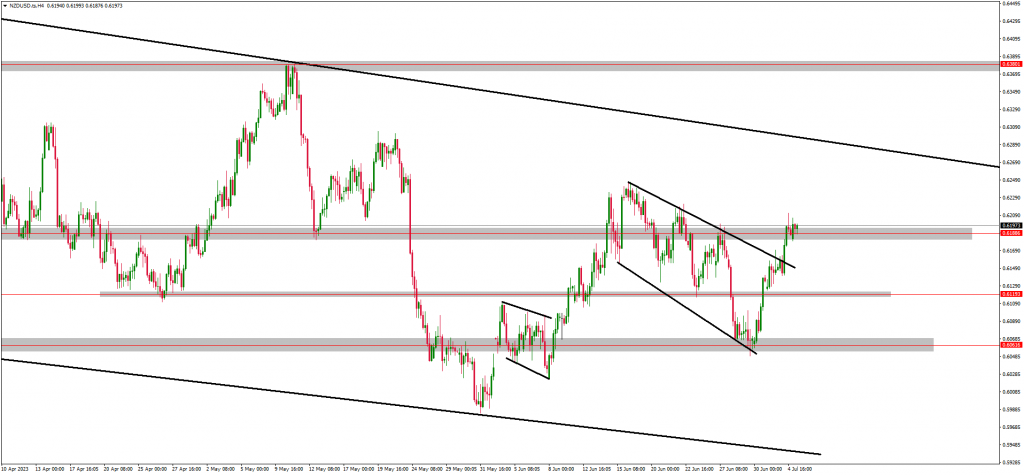

The NZDUSD Perfomance

(UPDATE) - NZDUSD is trading above a support zone.

NZDUSD continued to push to the upside and broke above the descending structure which suggests a continuation to the upside is possible. This price action is exactly what traders needed before forming a trading plan and strategy around this market.

Since the previous commentary, traders anticipate the market to continue pushing to the upside according to the breakout of the channel. As such, a retest of a correction will indicate a further push to the upside.

Read More: Crypto Keeps Their Strength In BTC and ETH

The US30 Performance

(UPDATE) - US30 is forming a continuation pattern.

US30 aggressively broke past the resistance zone around 34282.58 which traders expect to become a support zone. This price action on its own suggests that the bulls are interested in this market and perhaps anticipating more trading opportunities to the upside and also the forming of a bullish flag will add to the confluence. As such, traders anticipate US30 to rally back to the highs it created around 34944.80.

Final Thoughts On Today’s Analysis

Traders are keenly observing the bullish signs on the US30, NZDUSD, and GBPUSD trading pairs. These markets offer promising opportunities driven by various factors such as economic recovery, strong corporate earnings, infrastructure investments, robust New Zealand economy, commodity price surge, interest rate differentials, UK economic rebound, hawkish monetary policy, and Brexit resolutions. Watch our YouTube channel to learn more about our analysis.