The world of trading is dynamic and ever-changing, with various factors influencing the decisions of traders. In recent times, the market has witnessed an interesting trend with traders showing a bullish sentiment towards USDZAR, ETHUSD, and NGAS. Despite the fluctuations and uncertainties in the global financial markets, these assets have continued to attract the attention of traders.

In this context, it becomes important to understand the reasons behind this trend and the potential implications it could have on the market. In this article, we will explore the factors driving the bullish sentiment towards USDZAR, ETHUSD, and NGAS and examine the potential outcomes of these developments for traders and investors.

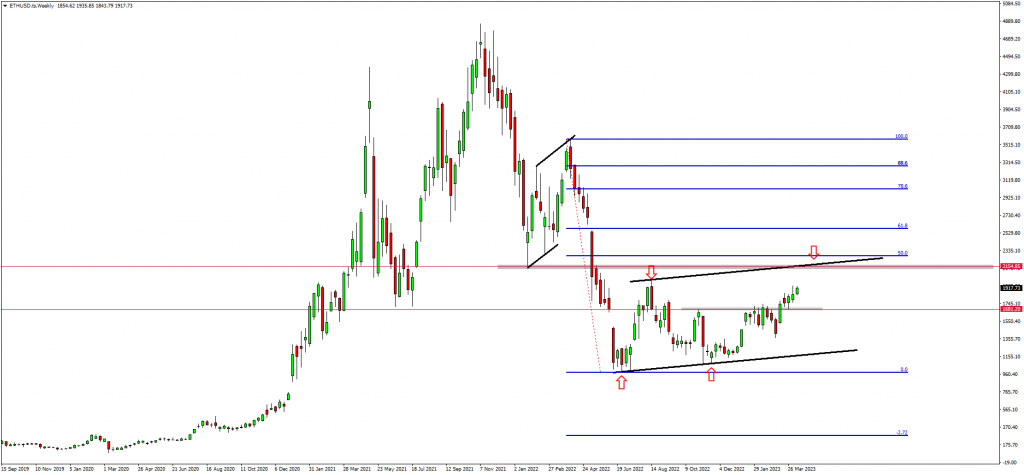

The Ethereum (ETHUSD) Performance

(UPDATE) - ETHUSD set for $2000.

A corrective structure is still forming on ETHUSD. Recently the market broke past the previous resistance zone around $1680.00 and confirmed more upside momentum.

According to this overall corrective structure, traders are bullish and have targets set on $2100 which will complete this pattern. As such, traders are looking for trend continuation trading opportunities.

The Natural Gas (NGAS) Performance

(UPDATE) - NGAS is breaking structure.

The support zone around 2.110 once again held the price of NGAS from dropping even more lower. Recently the market rejected the area and caused the price to rally to the upside and break above the descending channel.

According to this price action, there are possibilities of the market creating a double bottom on the daily timeframe which could see the price of NGAS pushing, even more, higher and ultimately change the trend. Therefore, traders seek trend continuation patterns to confirm more bullish momentum.

Read More: GOLD Heading Back To $2000 And Profit Taking

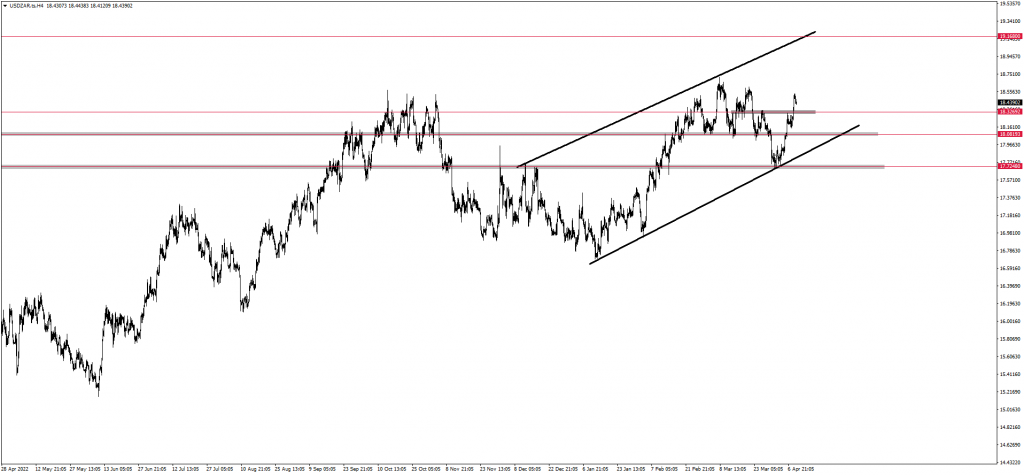

The USDZAR Performance

(UPDATE) - More ZAR weakness against the USD?

USDZAR recently bounced from the bottom of the ascending channel as well as the support zone that was created around 17.72480. These levels caused an aggressive push to the upside.

According to the overall market structure, traders anticipate USDZAR to continue the bullish momentum and break above the previous high of around 18.70. As such, any break and retest of structure will confirm more bullish momentum.

Final thoughts on today’s daily commentary

In conclusion, it is evident that traders continue to exhibit a bullish sentiment towards USDZAR, ETHUSD, and NGAS, despite the volatility in the financial markets. The reasons behind this trend vary, from geopolitical factors to technological advancements and changes in demand and supply dynamics.

It is essential for traders and investors to keep a close watch on these developments and factor in the potential outcomes while making their investment decisions.

While the market can be unpredictable, keeping abreast of current trends and analyzing the relevant data can help traders make informed decisions and maximise their profits. As always, it is crucial to exercise caution and diversify one's portfolio to minimise risk and optimise returns in the long run.

Looking for more insights? Subscribe to our YouTube channel today!