Traders worldwide are poised to closely monitor the upcoming US labour report, as the strength of the US dollar hangs in the balance. The employment data, which holds significant sway over financial markets, serves as a key indicator of the country's economic health and is likely to influence investment decisions in various sectors.

In this article, we delve into the importance of the US labour report, its impact on the US dollar's strength, and the implications it may have for traders.

The XAUUSD Performance

We have closed below the 1946.88 level as suggested. Remember, entries taken now are less conservative, there could be a retracement back to level 1964.94. Conservative traders could look at 1933.60. Target 1908.11

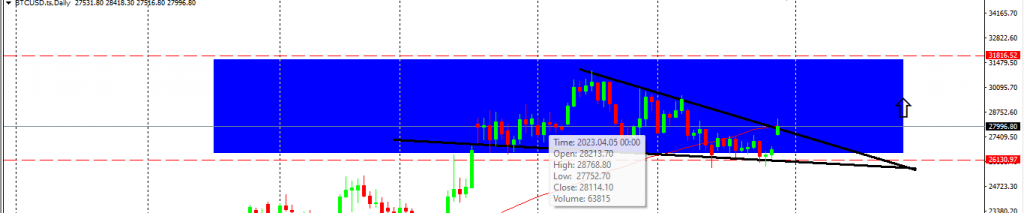

The BTCUSD Performance

Price has just broken out of the falling wedge. Remember, if the price breaks and closes above 31816.52, more upside to the price level of 42547.38. Requires more patience for price action to occur.

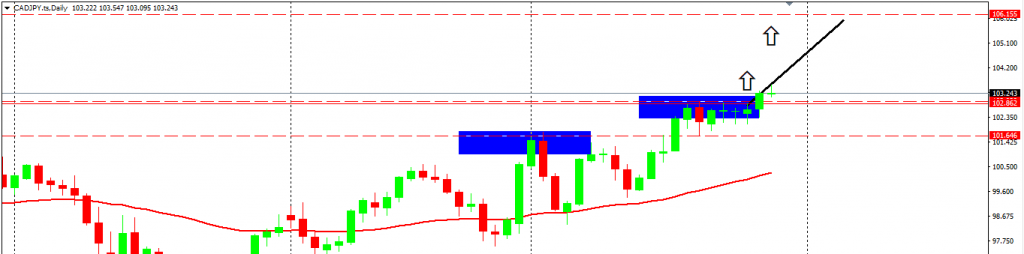

The CADJPY Performance

The price has broken above the 102.939 level. Resistance 102.862 was taken out as a sign that we are bullish BUT there could still be a retracement. Remember, we are focusing on target 106.155.

The AUDUSD Performance

The weekly candle has closed below both 0.65790 & 065441, a sign of bearish continuation. We may see a retracement earlier this week based on the start of Monday back to test 0.65790. This could be another entry for the traders that missed the previous sell-off.

Read More: USD Strengthening Amidst Uncertainty With Interest Rate Hikes

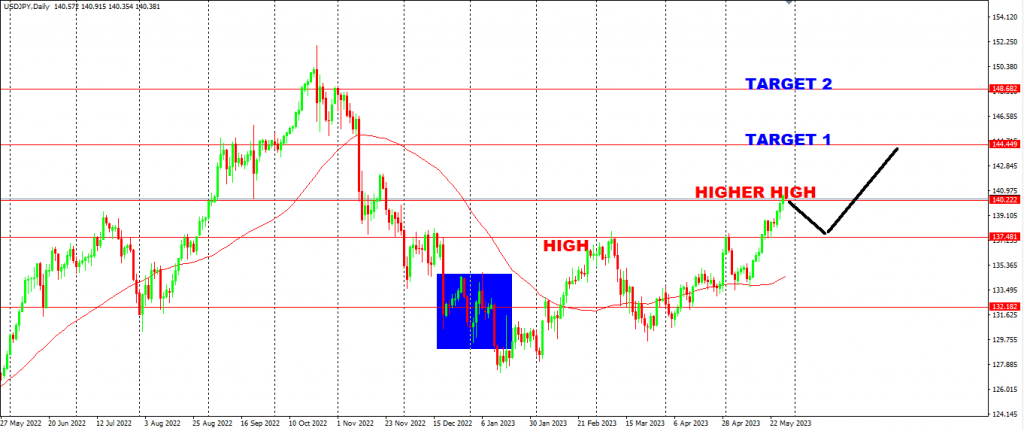

The USDJPY Performance

Price has broken and moved above a weekly pivot point. It has created a high and a higher high above 132.182. We could see a retracement to previous breakout levels at 137.481 Target 1 set at 144.449 and Target 2 set at 148.682.

Final thoughts on today’s analysis

The US Labour report remains a crucial barometer of the country's economic health and has a profound impact on the strength of the US dollar. Traders across various sectors closely follow this report to make informed decisions and adjust their investment strategies accordingly.

By monitoring key labour market indicators, Traders can gain valuable insights into market sentiment, potential currency fluctuations, and the performance of different asset classes.